Summary

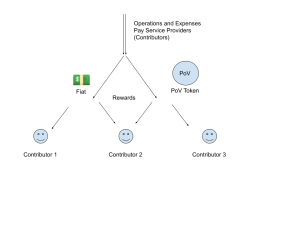

A Proof of Value economy bridges the gap between seed and series funding by creating a token economy that pays for labor services.

A PoV economy grows by distributing currency as non-monetary contributions are added to the organization. This model eliminates excess inflation, complies with U.S. securities laws, and is completely contributor-rewarded. The design seamlessly interfaces with traditional businesses and rewards contributors in their choice of digital or fiat currency.

Organizations that are able to pay value contributors in native crypto instead of fiat can redirect scarce cash resources toward essential operations. This, combined with the purchase/repurchase mechanism for funding, has the potential to redirect part of the VC market. Capturing just 1% of the venture capital market equated to $2.11 billion in 2021. Whichever platform creates the first working PoV protocol will have organizations flock to the system.

Opportunity

PoV economies work for both profit and non-profit organizations that need to interface with Web3 and traditional businesses. As we iterate, improve, and evolve the formulas and processes, we will continue to create new DAOs with goals of transformation, impact, and sustainability funded by our success and the community’s passion.

The tokenomics model takes a different approach than others currently in the market. It goes against the grain of Web3 projects in that it is not centered around NFTs, Games, or DeFi. This model allows underfunded organizations to utilize human capital

Vision

The PoV protocol was not inspired to break the current system – it is a means to evolve it. Time and again empires wax and eventually wane under tidal pressures of economies. The disintegration starts when economic systems lose integrity and filter wealth into densely allocated pockets, rather than taking advantage of the free-flowing nature currencies can provide.

Brokers, VCs, Intermediaries, hedge funds, landlords, and insurance companies all amass currency from the economy while rarely if ever, producing actual economic value. These are clots in the system. When blood can no longer flow, death flows. When currency does not circulate, economies collapse. The more densely wealth amasses, the less a currency circulates. This can either be fixed by disruptions in the free market, or revolutions. Do we start taking care of our economic health, or do we let our system rot, collapse, and rise from the ashes? The PoV protocol is designed to alleviate the top-down pressure of our currency flow and to start creating monetary systems which match the real labor value contributed to economies.

Digital economies have the potential to revolutionize how we interact with each other on the planet. But without proper economic models, community-building incentives, and oversight, we will repeat our fallacies with catastrophic results which we are already witnessing in our global ecosystem. The time is long past to bring efficiency back into the once-free market to conduct business and organizations as they were meant to be in a true economy. The PoV and other digital economy protocols will have the power to move refugees seamlessly throughout the globe, build community not-for-profit insurance companies, create jobs for 2 billion unbanked, and seamlessly integrate resource verticals for global trade with instant payment to worker-owners. We know the world will not be a utopian paradise, that isn’t how reality works. However, if we have the power to redirect even 1% of the world’s resources toward a more equitable, sustainable, and efficient economic system, we may finally be able to consider leaving our grandkids a habitable planet.

Why It’s Important

Funding – Funding is the million-dollar question. Anyone can provide capital to the PoV DAO for a predetermined buyback return. This has the potential of eliminating the startup’s need to approach banks, venture capitalists, and accredited investors. Microloans have allowed economic booms to occur in places like Africa, Asia, and South America, opening the financial floodgates for small business owners, community development, and unicorns. Institutional investors can still play with the new model, they just need to agree to a predetermined repayment. Capturing just 1% of the venture capital market equated to $2.11 billion in 2021.

Low Fees for Financial Transactions and Instruments – The only cost to execute transactions and use financial instruments is in the programming of the smart contract and the electricity used to execute it. Fees for financial transactions will be reduced from 3% to a flat fee of a few cents. Financial instruments such as escrow accounts, letters of credit, and loans will be written into smart contracts, eliminating the need for brokerage fees which can range from 1-3%. Additionally, it will allow unbanked individuals and high-risk countries to participate in financial ecosystems with little to no risk to either party since smart contracts cannot be compromised, only canceled.

Traditional Businesses – Can now bank in previously unbanked areas, allowing them to pay for products and services directly from business to business, person to person, and any mixture of the previous. Instead of relying on untrusted banks in developing economies, businesses and people can pay each other for products and services with cryptocurrency. Whether in a DAO or not, creating an economy among the unbanked will open up billions of dollars in untapped economic opportunities from resources and human capital in developing nations. There are currently 2 billion unbanked people in the world, most with access to smartphones and therefore digital wallets.

Economic Development and Nation Building – Many developing countries currently have an incredibly high demand for cryptocurrencies since their own currency is not as stable or valuable. Examples include Zimbabwe, Venezuela, Turkey, Russia, and North Korea. Any failed state, any revolutionary movement, or any economic development can be jump-started with the correct application of a cryptocurrency and a community that uses it. This value cannot be estimated as it starts in billions and is limitless given the proper application.

Payment Flexibility – Pay in fiat. Pay in crypto. Create more crypto to pay for products and services if there is no operational budget and the coin is worth something; like a government printing more money to pay for needed resources. If people trust the organization, they may opt to receive cryptocurrency instead of fiat because they trust in its strength. Initiatives, projects, R&D, community rewards, events, contests, etc. can all be purchased with a cryptocurrency that is believed to have value, freeing up operational capital resources for other parts of the organization.

Business Process IP – Business Process IP will be created through templating DAO systems by sequencing smart contracts, modularizing departments, developing turnkey projects, and discovering best practices. All of this IP can be patented, but the best use will be to let others use the template free of initial fees and take rewards in cryptocurrency for DAO architecture. I.e. it will cost the new DAO 15% of their initial 18-month mint projection to use the templated architecture. The Architect may also elect to take payment in the form of fiat if it is available.

Community Building – When people earn rewards by using products, they are likely to continue using said products. The difference in a PoV DAO is that the rewards are worth a fiat cash value. Programs like grocery store points, airline points, and Starbucks Rewards will now be worth a dollar amount instead of a free cup of coffee.

PoV Tokenomics Model

This is thought to be the first Proof of Value (PoV) Model. A PoV DAO mints tokens to inflate the economy only when a smart contract is executed which has provided a product, service, or other value-adds. The reward is equal to the estimated value of the DAOs economy. Initially estimated by the architect, rewards will be amended by DAO governance and will come in either fiat, PoV Tokens, or a mixture of both. The goal is to create an economic system that only mints currency equal to the value produced by the economy, thus eliminating excess inflation.

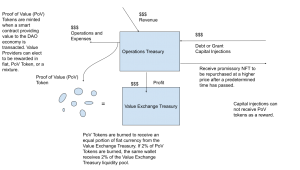

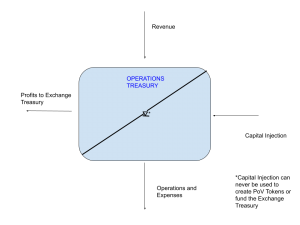

The system will rely on two treasuries, or liquidity pools: The Operations Treasury and the Exchange Treasury.

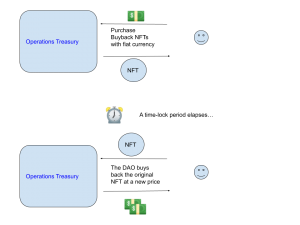

The Operational Treasury will hold fiat assets such as *Buyback NFT proceeds, product revenue, and grant funding. Only once all liabilities are met to a secure degree, will excess revenue be diverted to the Exchange Treasury.

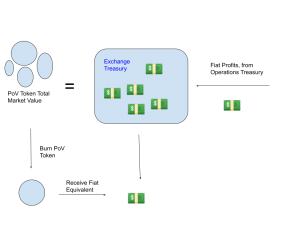

The Exchange Treasury will be filled by the net profits of the business, after all expenses, taxes, operations, and liabilities have been settled. Once fiat currency is in the exchange treasury, it cannot be removed unless by burning a PoV Token. This means the model is inflationary when labor is realized and deflationary when profit is realized. The Exchange Treasury will hold all of the net profits. Once fiat has landed in the Exchange Treasury, it will not be able to be removed unless the equivalent amount of DAO Tokens are burned. The DAO Treasury will not be permitted to purchase tokens and not burn them, due to the incentive for a predatory buy-back initiative to deflate the market by reselling them.

At any time, this PoV currency is redeemable for fiat currency, held in the DAOs Exchange Treasury. The baseline market cap of the DAO will always be exactly the amount of fiat in the exchange treasury. If there are 50,000 PoV Tokens in circulation and $5,000 in the exchange treasury, each token is redeemable for $0.10, at any time. As well, if there is no money in the Exchange Treasury, the Tokens are worthless in terms of pure exchange value. The only way to receive new tokens is by demonstrating a result-based value (PoV) approved by the DAO, generally in the form of labor towards the progress of the organization.

PoV Tokens will not be created through investment, staking, loans, or any other capital injection. In addition to grants, the DAO will be able to accept Buyback NFT proceeds as liabilities, for seed funding. When someone purchases a Buyback NFT, they are buying a Token that says they will be paid for the same NFT after a certain amount of time at a set price.

When looking for seed capital, all expected expenses should be taken into account before profit is realized including liabilities like loan interest. The more contributors who take crypto payment instead of fiat will allow more operations (such as larger marketing budgets) to commence thus leading to profit faster. The capital injection should be large enough to cover operating expenses assuming every contributor will want fiat currency immediately for payment. This will also be the initial number of coins expected to be minted before profit is realized and the coins gain value.

Initially, many, if not most, service providers will not accept PoV Tokens as full payment. They will need to be paid in fiat, up-front, or take a mixture of fiat and PoV Token cryptocurrency. For example, Shopify will not accept our newly minted Tokens (yet, anyway!). There must be money, in the form of credit or debit given to Shopify in order to utilize services. The same can be said for domain hosts and content management software services. However, a community manager who understands and wants to add value may take full payment in Tokens. When they decide to redeem their tokens for fiat is at their own discretion.

The seed funding will only fund the Operating Treasury, as opposed to the Exchange Treasury, which will be funded by net realized profits. This also requires that the DAO only accepts capital injections equal to the projected Operating Treasury expenses plus a contingency buffer. The Operating Treasury will fulfill all operational obligations including liabilities, wages, services, taxes, and other costs. If the operational runway dips below a set point (likely decided between the DAO Architect, DAO Management, and General Contributors) it will not add to profits until it has been refilled, incentivizing the DAO to either adjust spending/income or adjust the operational runway threshold. There will always be a delay between the inflationary mechanism of minting Tokens and the deflationary mechanism of realizing a profit. This may incentivize PoV providers to hold on to their newly minted tokens. When run through simulations, in every case in which profit continues to flow, those who hold on to their tokens longest benefit the most.

Each Proof of Value smart contract completed for the DAO will mint a number of tokens dictated by the approximated value of the service, determined by the DAO (community, architect, manager, or department). Whatever portion of the payment is elected to be taken in cash, the reciprocal portion of the tokens will be minted. For example, there are 2 continuous jobs: Community Manager and Web Platform Services (WPS). WPS will only take online payments, in fiat, via a debit/credit card linked to a traditional bank account. However, the Community Manager elects to take 90% of his payment in Tokens and 10% in fiat. The Community Manager costs $50,000 annually in the US Market and WPS costs $20,000. The annualized $20,000 must be paid immediately when the smart contract is fulfilled, or even before, with remittance being an option. The Community Manager must be paid monthly, as well. Each month, $1,666 is sent from the DAO Operations Treasury to WPS. Also each month, $417 is sent to the Community Manager as well as 3750 PoV Tokens, redeemable, in fiat, to the Exchange Treasury. Initially, the exchange treasury will be empty, so the Tokens will not be redeemed for anything, but they still may redeem (or burn) their tokens – this scenario will be applicable in a not-for-profit or non-governmental organization. However, the PoV Token will always be redeemable for its % share of the Exchange Treasury. Up-front operational fiat expenses will be paid out of the Operating Treasury.

One of the ways people can get involved or add value to the business is by providing a service in a management or broker capacity. This is accomplished by paying for a product or service out of pocket and being reimbursed in PoV Tokens or fiat currency. Repayment must be approved by the DAO, it will behoove the contributor to gain approval from the DAO before purchasing services.

Tokens are only distributed once a project (or sub-project so as not to inflate PoV Token volume in large tranches, causing instability) is completed, to all participants who added value. When a project is created, the tokens are held in escrow until the final project smart contract is completed with approvals and reviews.

Contributors who have completed identical or congruent smart contracts before (like monthly accounting statements), will be given the first right of refusal to complete the next smart contract. If they cannot pass a round of reviews in 3 attempts or do not complete the smart contract in time, the triage for smart contract bidding will go to other DAO labor providers. Next will be the community, and finally outside resources. If there are no resources to be found, it is up to the DAO Coordination Department to search for and fill the position. Some tasks or smart contracts may require KYC, accreditation, or past proven success in order to submit for smart contract completion.

In the beginning, token rewards will be heavily favored to be given by the DAO since it will not have cash flow or assets. Minting tokens as a measure of value will be at the approximate value the services are worth. If a product or service is valued at $5000 a month, the DAO will reward 5000 Tokens in lieu of fiat payment. It will be more profitable for the individual to wait until the profit realized has outweighed the estimated labor value realized. There is potential to build a mechanism so that PoV Tokens cannot be burned before a certain date or profit threshold.

When the PoV Token value raises above the fiat value, it means that there has been more profit realized than the estimated economic value put into the DAO and the business will be considered a success, for the time being. Once this happens, DAO Coordination will need to put forth proposals to lower the PoV rewards, should service providers choose to accept those in lieu of fiat, to match the congruent fiat reward. E.g. if PoV Token is now worth $1.50, a job that previously distributed 1000 tokens will now distribute 667.

Governance

Governance will be administered on an equity-based scale with a diminishing time function based on how much economic value a contributor has provided. Governance Tokens are created as separate rewards from financial commodities (PoV Token + fiat). Governance rewards will be unique to the contributor in that each reward value is tied to a task, project, department, and review standard. This allows contributors to build accreditation when voting on departmental and project decisions. A contributor with expertise in accounting should not be making decisions on color schemes unless they also happen to be skilled and accredited in chromatics. A contributor’s governance rewards start to diminish after they are distributed. This creates a system where the most recent contributors have more of a say in DAO processes and direction. Although a contributor’s voting power may diminish, their accomplishments and accreditation from previous contributions will be stored on record in the blockchain.

For each vote, there will need to be a threshold set for the percentage of votes required for a proposal to pass. The suggested starting place will be 75% for most decisions. For example, if both contributors and debt providers have 50% say in how operational treasury money is spent, what portion goes to profit, and what rate and runway of debt repayment is realized, the majority of the users affected will have to agree to change the budgeting structure.

Positives about DAO token structure

- Not a security – should not trigger the Howie test. Proof of Value tokens are created based on estimated economic value added.

- Inflation will be value-based, rather than algorithmic or time-based.

- Once profit starts to flow, tokens will always have a base value

- Free Market demand for PoV tokens due to future projections could incentivize the global labor market since tokens will be in demand.

- Inflationary and deflationary mechanisms balance in time to represent the true value of the organization.

- Once profit is realized, it will never leave the Exchange Treasury, thus there will always be a base token value. The only way the Exchange Treasury will be empty is if every coin is burned and exchanged for fiat assets. Temporarily, any newly minted coins will be valueless, just like at the inception of the DAO. However, profit should follow whenever labor value is realized by the execution of a smart contract. How long it takes the profit to be realized could be the hedge bets and options imitation within the token economy, if PoV Tokens were able to be traded in free markets as securities. These tokens could become securities if the DAO is successful enough to apply with the SEC or operate in alternative jurisdictions and not interact with the American labor market.

- DAO can be interfaced with new adopters and traditional organizations alike. As well, value providers can elect to receive rewards in fiat or PoV Token.

Unknowns about DAO token structure

- How to pass the Howie test for PoV tokens on secondary markets.

- Gap between inflation and deflation is room for unknowns – speculations, hedging, token demand, and supply flux.

- At first, everything will need to be custodial in structure to ensure bad behavior or incorrect assumptions can be corrected. The DAO Coordinator Department will have ultimate authority but will be encouraged to not interfere with the autonomy of the organization. This is because we understand the first iterations of these organizations will not be perfect since there have not been enough DAOs built over enough time to understand what truly works as a sustainable organization.

Community Rules

As marketing budgets grow, the community will grow. It will be the DAO’s responsibility to drive community value and promote interaction. In the initial instance of the DAO, it is proposed that 15% of the Revenue going to Operations Treasury will go towards community rewards every month: 5% going to moderators, 5% going to content contributors, and 5% going to members at large. As revenues grow, community rewards will grow. Rewards will be one of the mechanics used to promote community interaction.

Moderators are responsible for keeping the community safe and free of content that violates community rules.

Content creators range from question-askers to resource providers. Anyone who adds original or linked content, media, and resources (which fall in community guidelines) will be rewarded from the 5% pool proportionally to the value brought to the community, decided by the community based on reactions, shares, and other traditional social media methods.

The Members at Large are those who interact with content, take surveys, share to their networks, comment on posts, and other base-line social media behaviors which do not involve creating or linking new information and will share in a 5% pool, each according to the value provided on a monthly basis.

Rewards will be distributed in fiat or PoV tokens, depending on the community participant’s choice, in their wallet. Wallets will be custodial as an additional measure to prevent catastrophic events from destroying the DAO. In order for the community participants to collect rewards, they will need to pass standard KYC and other measures depending on jurisdiction to retrieve their funds. We will connect to the standard fiat bridges like MoonPay.

Smart Contract Rules

Each contract will have the minimum information:

- Department

- Project

- Task

- Description

- Resources

- Completion Time

- Previous Contracts – contracts needing completion before this one

- Dependent Contracts – contracts requiring this one to be completed

- Payment Rewards

- Voting Rewards

- Accreditation Rewards

- Review and Approval Method

- Contingencies – commissions, special rules, circumstances

Initial Contributors

Starting out, specific, qualified individuals will be invited to participate in the DAO who have demonstrated acumen in the departments and projects they are participating in. However, the business structure may resemble traditional roles with new lenses. Each role is now considered a department with one or more contributors participating in projects within the department. Projects are broken down into tasks, which are completed once a smart contract has been fulfilled. Once a smart contract is completed, it will release fiat funds or Proof of Value Tokens to the value creator(s) who completed the task. Many task rewards may be held in escrow until a project, or a major milestone in a project has been completed. Initial contributors and departments for the Token Economist DAO are listed in the Appendix.